Ethereum Price Prediction: Pathway to $5,000 and Beyond

#ETH

- Technical Breakout Potential: ETH trading above key moving averages with improving MACD momentum suggests near-term upside toward $5,000 resistance

- Institutional Catalyst: $287M ETF inflows and major acquisitions signal growing institutional confidence in Ethereum's long-term value proposition

- Market Structure Shift: Tokenization of real-world assets and declining exchange reserves create fundamental support for sustained price appreciation

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

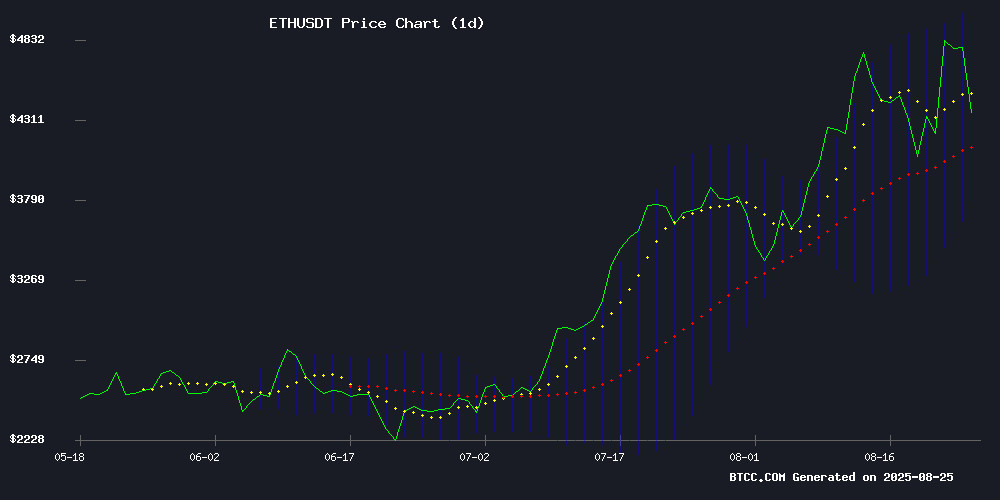

Ethereum is currently trading at $4,598.52, comfortably above its 20-day moving average of $4,374.86, indicating sustained bullish momentum. The MACD reading of -316.13, while negative, shows improving momentum with a positive histogram of 28.68, suggesting potential trend reversal. The price sits within the Bollinger Band range ($3,772.42 - $4,977.29), with current levels approaching the upper band, signaling strong buying pressure. According to BTCC financial analyst Mia, 'ETH's position above the 20-day MA combined with narrowing Bollinger Bands suggests consolidation before a potential breakout above $5,000.'

Market Sentiment: Institutional Demand and ETF Inflows Drive Optimism

Recent developments paint a bullish picture for Ethereum. Tokenized real-world assets potentially unlocking a $400 trillion traditional finance market, combined with $287 million ETH ETF inflows led by BlackRock, create strong fundamental support. Despite phishing scams exploiting EIP-7702 resulting in $1.5 million losses, institutional demand remains robust with Bitmine acquiring $45 million in Ethereum. BTCC financial analyst Mia notes, 'The combination of institutional ETF inflows, exchange withdrawals of 200,000 ETH in 48 hours, and Powell's dovish shift creating short squeezes indicates strong underlying demand that could propel ETH past $5,000 in the NEAR term.'

Factors Influencing ETH's Price

Tokenized Real-World Assets May Unlock $400T TradFi Market, Says Animoca

Tokenization of real-world assets (RWAs) could unlock a $400 trillion traditional finance market, according to new research from Web3 digital property firm Animoca Brands. The sector has already reached $26.5 billion in tokenized value this year, marking a 70% growth since January 2025.

Private credit and U.S. Treasurys dominate the space, accounting for nearly 90% of tokenized value. ethereum leads the ecosystem with a 55% market share, expanding to 76% when including layer-2 solutions. Analysts suggest this growth may benefit projects like ETH and Chainlink, with interoperability seen as critical for long-term success.

"The estimated $400 trillion addressable TradFi market underscores the potential growth runway for RWA tokenization," wrote Animoca researchers Andrew Ho and Ming Ruan. Institutions are increasingly showing confidence in onchain financial products, signaling momentum for the nascent asset class.

Ethereum's Diverging Momentum: Retail Activity Offsets ETF Outflows

Ethereum's market narrative has split into two distinct threads. While U.S.-listed ETFs recorded their first weekly outflows in 15 weeks—$241 million withdrawn during the August 22nd period—on-chain metrics reveal surging retail participation. The divergence suggests institutional investors may be tapping the brakes just as grassroots activity accelerates.

Failed transactions on the Ethereum network, often indicative of retail-driven DEX trading surges, spiked above 200,000 this week. This technical pattern has historically preceded price bottoms and subsequent recoveries. The bulk of ETF redemptions came amid inflation concerns, including a $429 million single-day outflow before dovish Fed commentary stabilized markets.

Phishing Scams Exploit Ethereum's EIP-7702, Resulting in $1.5M Losses

Analysts are sounding the alarm over a surge in phishing scams targeting Ethereum addresses upgraded under the new EIP-7702 standard. Anti-fraud service Scam Sniffer reports at least three victims this month, with combined losses exceeding $1.5 million.

The EIP-7702 feature, introduced in May's Pectra upgrade, enables Externally Owned Accounts to temporarily function like smart contracts. While designed to improve transaction efficiency, this functionality has created fresh vulnerabilities for exploitation.

In the most recent case, a victim lost $1.54 million after approving malicious batch transactions containing token transfers and NFT approvals. Funds were subsequently bridged to Ethereum Mainnet via Relay Protocol. This follows two similar incidents where investors lost $1 million and $66,000 respectively to identical phishing schemes disguised as Uniswap swaps.

Ethereum Shorts Evaporate as Powell's Dovish Shift Ignites Rally

Ethereum surged to a record $4,957 Sunday as Federal Reserve Chair Jerome Powell's Jackson Hole comments triggered a violent short squeeze. Approximately $120 million in Leveraged bearish bets collapsed within one hour of Powell signaling potential rate cuts, with CoinGlass data showing $53 million of that total being instantaneously liquidated shorts.

The cascade began when Powell stated restrictive policy 'may warrant adjusting our stance.' Traders who borrowed ETH to bet against it faced margin calls as prices spiked, forcing panic buybacks that accelerated the rally. This reflexive liquidity crunch mirrors classic short squeeze dynamics seen during Bitcoin's 2020 breakout.

Corporate holders rode the wave, with Bitmine Immersion and SharpLink Gaming gaining 12% and 15% respectively. The moves erased Bitmine's 7% weekly loss as institutional ETH exposure proved advantageous. Conversely, Peter Thiel-backed ETHzilla cratered 31% after attempting to dilute holdings with a 74.8 million share offering.

Ether Soars In August—But Will September Spoil The Party?

Ethereum's native token, Ether, has surged approximately 20% in August, reaching $4,745 at publication time. The rally briefly pushed prices above $4,860 following dovish comments from Federal Reserve Chair Jerome Powell at the Jackson Hole symposium—a development some traders interpret as a catalyst for further gains.

Historical data from CoinGlass suggests caution. Since 2016, Ether has risen in August only to decline in September on three occasions. In 2017, a 92% August rally preceded a 20% September drop. Similar patterns emerged in 2020 (25% gain followed by 17% loss) and 2021 (35% climb then 12% retreat). crypto trader CryptoGoos notes September typically posts negative returns in post-halving years.

Market structure and participant profiles have evolved since these historical pullbacks. Notably, September declines in 2016 and 2020 gave way to multi-month recoveries, with Ether finishing those years strongly. Whether current fundamentals can override seasonal trends remains the critical question for traders.

Ethereum Price at Crossroads: Accumulation Signals Confidence Amid Pullback Risks

Ethereum's rally has emerged as one of the most robust among major altcoins, yet traders remain divided on its next move. The cryptocurrency hovers near $4,770, with two plausible scenarios: a short-term retracement or a breakout toward $5,500. Both outcomes find support in on-chain dynamics.

Large holders continue accumulating ETH despite its proximity to all-time highs. Wallets holding 1-10 million ETH increased their positions by 210,000 ETH ($1 billion) since August 19, while the 10-100 million ETH cohort added 140,000 ETH ($668 million). This stealth accumulation suggests institutional confidence in Ethereum's long-term value proposition.

Contrasting this bullish sentiment, the Liveliness metric—tracking coin dormancy—has climbed to monthly highs above 0.70. Historically, such spikes precede localized pullbacks as long-held coins move. Yet the scale of accumulation may limit downside potential, creating a tension between profit-taking and strategic buying.

CryptoPunks Lead NFT Market with $2.8M Weekly Sales

CryptoPunks continue to dominate the NFT sector, amassing $2.8 million in sales over the past week. The collection's top performers include CryptoPunk #1082, which sold for 80 ETH ($348,400), alongside #2596 and #5477 fetching 73 ETH ($315,200) and 66 ETH ($280,980) respectively. These high-value transactions underscore sustained demand for blue-chip digital assets despite broader market volatility.

Secondary sales of CryptoPunks #3704, #8864, and #9120 contributed significantly to the weekly volume, with four additional Punks collectively adding $1.03 million. The data from Phoenix and DappRadar confirms CryptoPunks' enduring status as the benchmark for NFT valuation and liquidity.

Investors Withdraw 200,000 ETH From Exchanges in Just 48 Hours: Here’s What Next for Ethereum

Ethereum's market dynamics are shifting as investors pull 200,000 ETH from exchanges within two days, signaling growing confidence in the asset's long-term potential. Analysts interpret this movement as accumulation behavior, with tokens likely migrating to private wallets for staking or deferred trading.

The withdrawals coincide with Ethereum breaching its 2021 all-time high, reaching $4,885 on August 22. Institutional players appear to be driving both the price surge and exchange outflows, creating a supply squeeze that could amplify upward momentum.

$287M ETH ETF Inflows Led By BlackRock Trigger Institutional Gold Rush, Traders Flock To Unilabs Finance 100X Opportunity

Ethereum ETFs have drawn $287 million in inflows this week, with BlackRock accounting for $233 million of the total. Fidelity contributed another $28 million, underscoring growing institutional confidence in ETH. The ethereum price has responded positively, climbing 7.49% over the past week to $4,738.

Wall Street's deepening involvement in Ethereum-backed products is being likened to a digital Gold rush. Meanwhile, Unilabs Finance is emerging as a high-potential DeFi play, with some traders speculating about 100X returns. The project is gaining traction as capital floods into the broader Ethereum ecosystem.

Ethereum Price Analysis: Is ETH About to Break Past $5K After Recent ATH?

Ether remains in a strong uptrend on higher timeframes, yet bearish divergences on daily and 4-hour RSI indicators signal potential exhaustion. The cryptocurrency briefly touched $4,884 before consolidating, failing to sustain momentum for a decisive breakout. Analysts warn of a possible retracement toward $4.1K unless buyers defend the $4.4K support level.

Technical charts reveal a critical inflection point. The daily timeframe shows ETH forming a marginally higher high while RSI paints a lower high—a classic divergence pattern. Immediate support clusters between $4,400-$4,450, with a deeper retracement potentially testing the Fibonacci confluence zone at $4,070-$3,900. Market structure suggests these levels may attract accumulation if tested.

Four-hour analysis mirrors these concerns. Despite price action reaching new highs, fading momentum appears through declining RSI readings. Liquidity pools around $4,477 and $4,311 now serve as make-or-break levels. A breakdown here could trigger accelerated selling toward the psychologically important $4K threshold.

Tom Lee's Bitmine Acquires $45M in Ethereum as Institutional Demand Surges

Ethereum shattered its all-time high with a 14% surge to $4,886, outpacing Bitcoin's consolidation as institutional interest intensifies. Bitmine's $45 million ETH purchase mirrors broader accumulation trends among funds and whales, reinforcing Ethereum's dominance in decentralized finance.

On-chain data reveals accelerating demand, with large holders expanding positions. The asset's role as the leading smart contract platform now drives price discovery, pushing ETH toward uncharted territory amid growing market confidence.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and market fundamentals, Ethereum shows strong potential for growth across multiple time horizons. The convergence of institutional adoption through ETFs, growing DeFi and NFT ecosystems, and the potential of tokenized real-world assets creates a compelling long-term narrative.

| Year | Price Prediction | Key Drivers |

|---|---|---|

| 2025 | $5,200 - $6,800 | ETF adoption, Ethereum 2.0 upgrades, institutional inflow |

| 2030 | $8,000 - $15,000 | Mass DeFi adoption, regulatory clarity, scalability solutions |

| 2035 | $15,000 - $30,000 | Global tokenization trends, Web3 infrastructure dominance |

| 2040 | $25,000 - $50,000+ | Mainstream financial integration, store of value status |

These projections consider Ethereum's current momentum, technological roadmap, and growing institutional interest, though market volatility remains a constant factor.